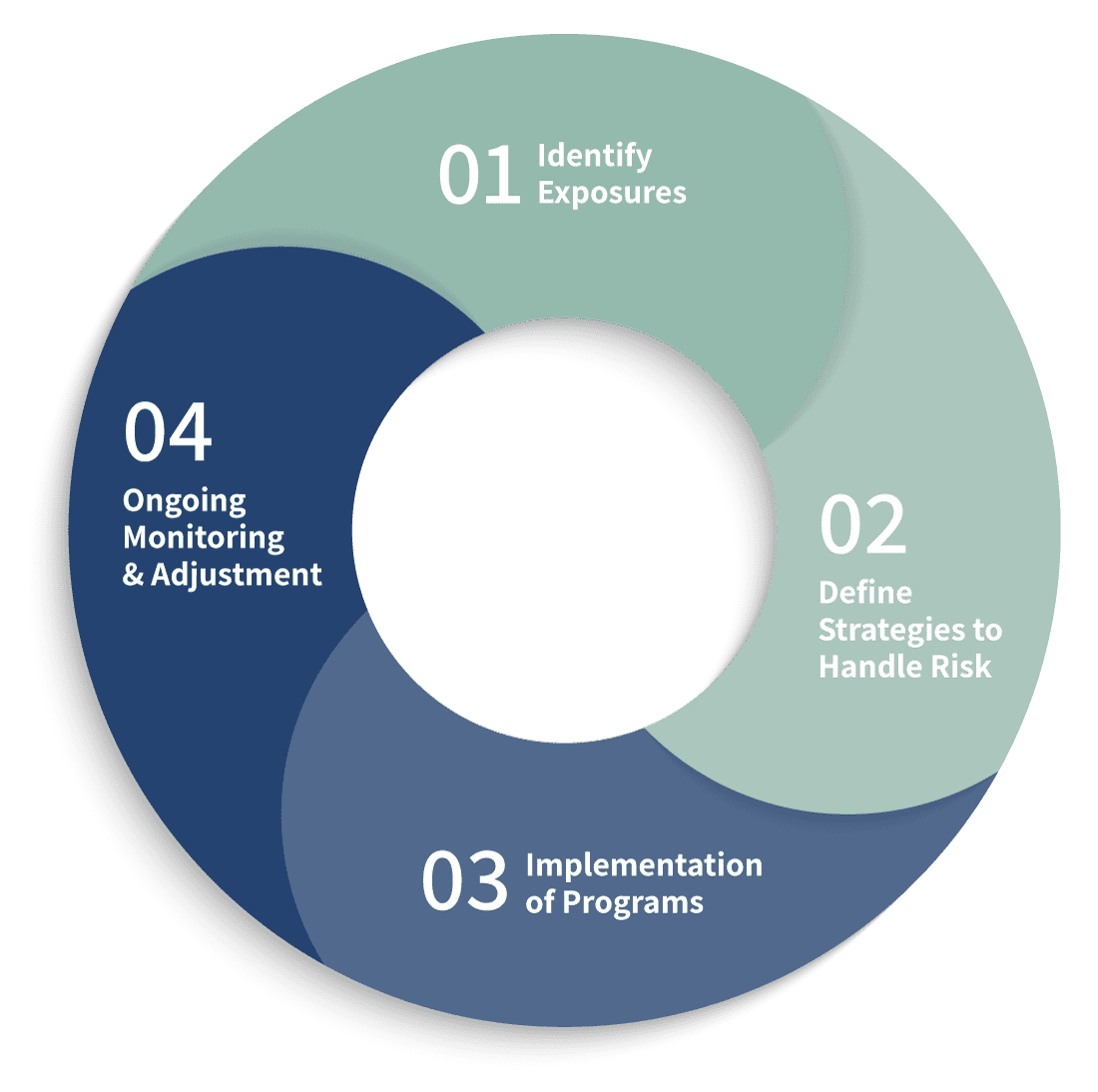

Our four-step method to identify, understand, implement and monitor risk management strategies for your business.

Home »

Protect your team with our Risk Guard Process.

Many insurance agents claim to be “risk managers,” in all actuality all they do is get quotes from as many companies as they can. At McClure, Bomar & Harris, our goal is to reduce your actual risk exposures, not just sell a commodity-based product to you.

Our unique approach allows us to get a deep understanding of your company, and what sets you apart from your competition. It also allows us to discover hidden issues and problems that may be lurking in the shadows of your business. We want to make sure that you are focused on your business, not the business of risk management.

The McClure, Bomar & Harris Risk Guard™ process is a continuing four-step method to identify, understand, implement and monitor risk management strategies for your business.

They will insure you

What coverage and terms they will offer

What price they will charge

Our Risk Guard Process

Step 1 – Identify Exposures

During this crucial initial phase, we invest the time to understand every facet of your business in order to help you and your team identify the risks that face your business. By evaluating the effectiveness of risk management programs, practices and resources under real-world conditions, we assure that your assets receive precisely the right type of protection.

Step 2 – Define Strategies to Handle Risk

Once we have developed a thorough understanding of your business, including your industry, corporate culture and operating procedures, we move beyond insurance, exploring a spectrum of proven alternative strategies to minimize risk and reduce insurance costs.

Step 3 – Implementation of Programs

During the implementation process, we put in place specially tailored programs and strategies designed to protect your assets while reducing insurance costs. A strong belief in our process motivates underwriters to offer much lower insurance costs on your behalf.

Step 4 – Ongoing Monitoring & Adjustment

You and your business are dynamic – what works for you today might not work as well tomorrow. For this reason, we continue to monitor and adjust your risk management programs to ensure a perfect fit as your business evolves and changes.

Improving your Risk Profile creates competition among companies in the insurance marketplace, and improves your overall bottom line.

Insurance carriers love the Risk Guard Process for a number of reasons including enhanced new business “success ratio,” retention and outstanding loss ratios. The following represent a few quotations from Regional and Branch Managers of national insurance companies:

Because of the Risk Guard Process, we can quickly make informed decisions on risk selection and pricing; and offer the insured our most favorable terms and conditions.

The Risk Guard Process offers a more in-depth understanding of an insured’s operations and exposures. It also enables us to gain comfort with the risk and more of a willingness to accept the risk.

The comprehensive risk strategy employed through the Risk Guard Process embodies the concept of intimacy, intensity and integrity. The Risk Management Audit greatly clarifies the risk acceptance and pricing decisions by us and allows more comfort and flexibility in program design.

We have great faith in the Risk Guard Process. It leverages all element of the Risk Management Process (diagnosis, design, implementation and monitoring) which invariably leads to a more rational and efficient allocation of our financial and human capital.

The Risk Guard Process quantifies both the hard and soft costs affecting customer margins, provides a much higher degree of customer satisfaction and retention, and greatly clarifies risk acceptance and pricing decisions by us.

Risk Guard Process Quote Request

As an independent agency, we offer multiple options at competitive prices.